Section 2: Configure Default Coding (Supplier/Item/Customer)

Default coding automatically applies pre-defined values to transaction fields when a specific Supplier, Item, or Customer is identified on a document. This is useful for setting standard GL codes, tax rates, or dimensions associated with particular entities.

Use Case Example: Automatically set the default GL Account and Tax Rate for all invoices received from a specific supplier.

Steps (Example for Supplier Default Coding):

- Navigate to Supplier Record:

- Go to the Relationships module > Suppliers submodule.

- Find and click on the supplier you want to configure defaults for.

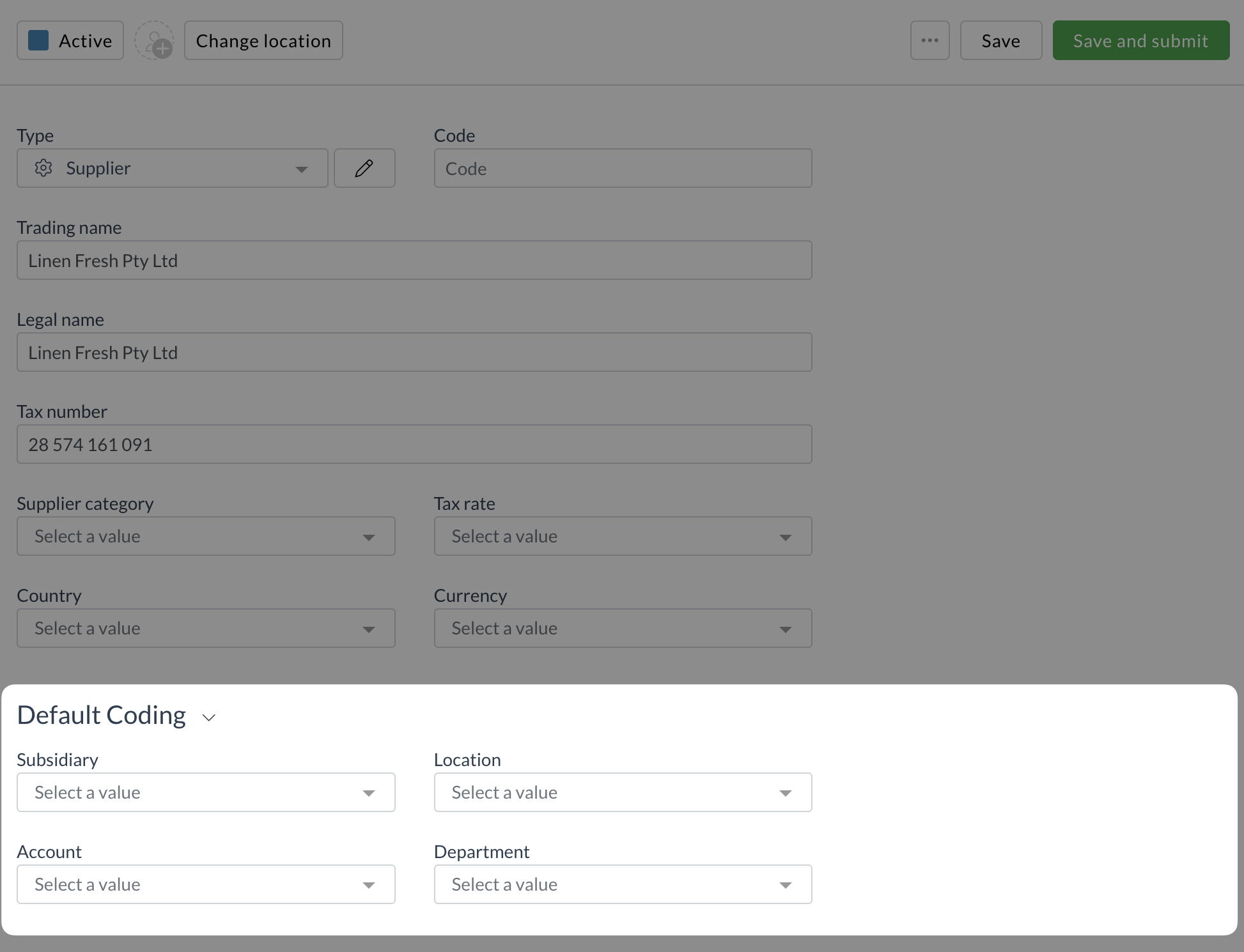

- Locate Default Coding Section: Scroll down within the supplier record modal to find the "Default Coding" (or similarly named) section.

- Set Default Values:

- Click into the field you want to set a default for (e.g.,

Default Account Code,Default Tax Rate). - Select the desired default value from the drop-down list.

- Click into the field you want to set a default for (e.g.,

- Repeat for Other Fields: Set defaults for any other relevant fields available in this section.

- Save Changes: Click Save at the bottom of the supplier modal.

- Repeat for Other Entities: Follow similar steps for setting defaults on Item records (via Inventory > Items) or Customer records (via Relationships > Customers) as needed.

- Test: Process a document where the configured supplier/item/customer is matched and verify that the default values are automatically applied to the relevant fields. You might need to use the "Apply Trained Rules" function (... > Apply trained rules) on an existing document if the defaults were added after the document was initially processed.

What Happens Next?

Default coding rules are active. They apply when the corresponding entity is matched or when "Apply Trained Rules" is used. Next, let's configure dependencies between fields.

Next Section: Configure Dependencies

Related How-To Guides: